SSI and SSDI Benefits for Eligible Americans: A 2.5% (COLA) livelihood adaptation will be provided to recipients of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) in 2025. This annual increase, announced by Social Security Administration (SSA), helps recipients preserve their purchasing power in a changing economy and keep up with inflation. For millions of Americans, the new SSI and SSDI payment plans and 2025 Cola Rise offer urgently needed breaks.

Understanding your payment schedule and making the most of your benefits are essential for financial security, regardless of whether you get $1,580 in SSDI as an individual or $1,450 in SSI as a couple. You can handle your benefits with confidence if you use SSA’s online resources, plan ahead, and stay informed. Keep in mind that the greatest approach to safeguard your financial future is to be proactive, and review the official SSA schedule.

SSI and SSDI Benefits 2025: Overview

| Aspect | Details |

| COLA Increase | 2.5% for 2025 |

| SSI Maximum Payment | The maximum monthly SSI payment for individuals is $967, and for couples, it is $1,450. |

| SSDI Average Payment | $1,580/month (up to $4,018/month max) |

| SSI Payment Schedule | Usually on the first of the month (with adjustments for weekends and holidays) |

| Schedule of SSDI Payments | by Date of Birth (the second, third, or fourth Wednesday of every month) |

| Additional 2025 Modifications | Adjusted full retirement age, increased taxable wage base, and repeal of WEP/GPO provisions. |

| Official Resource | https://www.ssa.gov/ |

$890 Centrelink Bonus Payment April 2025: Check New Update & Payment Date

Cash app settlement 2025 Payout Status: Check Payout Date, Maximum Payment

Recognizing the COLA Increase in 2025

Urban Wage Earners and Clerical Workers (CPI-W) Consumer Price Index is used annually by SSA’s to assess whether COLA is needed. Millions of Americans relying on state income and disability assistance will increase by 2.5% by 2025. This will incur additional monthly income to support payments for growth costs such as suppliers, food, rent, and healthcare. For those people, even a small increase of 2.5% can have a big impact.

SSDI Benefits Described

Eligibility Requirements for SSI

SSI and SSDI Benefits is based on increased needs for the elderly, those with disabilities, and those with limited resources and incomes. The purpose is to pay for essential items such as clothing, food, and living spaces.

What Will You Receive?

- Single: Up to $967 per month.

- Couples that qualify: up to $1,450 per month.

Although some states provide extra benefits, these are the federal baseline payments, which could raise your monthly total. For local information, contact the Social Services department in your state.

SSI Payment Dates 2025

| Month | Payment Date | Notes |

| April | April 1, 2025 | Regular payment |

| May | May 1, 2025 | Regular payment |

| May (June’s pay) | May 30, 2025 | Payment in early June (Because June 1st falls on a Sunday). |

| July | July 1, 2025 | Regular payment |

| August | August 1, 2025 | Regular payment |

| August (pay for September) | 29 August 2025 | Payment in advance of September (September 1st is a holiday) |

SSDI Benefits Described

Who is eligible for SSDI?

All the Employees, who contribute to the Social Security through wage taxes and are currently unable to qualify for the SSDI due to a qualified disability, your medical condition and employment history and determine your eligibility.

What Will You Receive?

- Benefit on average each month: around $1,580.

- Benefit maximum each month: $4,018 based on your salary history.

Schedule of Payments for SSDI 2025

Your birthday determines when SSDI payments are scheduled:

| Birthday Range | Payment Day |

| 1st to 10th | 2nd Wednesday of each month |

| 11th to 20th | 3rd Wednesday of each month |

| 21st to 31st | 4th Wednesday of each month |

| Benefits started before May 1997 | Benefits began on the third of every month prior to May 1997. |

Additional 2025 Social Security Changes

WEP and GPO repeal: The Social Security Fairness Act of 2023 ultimately eliminated two contentious regulations in early 2025:

- Government Pension Offset (GPO).

- Windfall Elimination Provision (WEP).

Previously, these regulations decreased benefits for retirees in the public sector who were receiving a pension that was not covered by Social Security. Their removal results in rises of up to $1,190 per month for some widowers and $360 per month on average for impacted retirees.

Increased Cap on Taxable Earnings

The highest income that is liable to Social Security taxes in 2025 is $176,100, up from $168,600 in 2024. Higher earners are impacted because they will contribute more to the system and might eventually receive greater benefits.

Adjustments for the Full Retirement Age

The current full retirement age for individuals born in 1959 is 66 years and 10 months. It rises to 67 years for people born after 1960.

$1400 stimulus check 2025 deadline: Process of Tracking Your IRS Deposit & All Details

$697 Direct Deposit Checks 2025: Check Payment Details, Eligibility & Application Process

Useful Advice for Eligible Americans Receiving $1,450 and $1,580 in SSI and SSDI Benefits

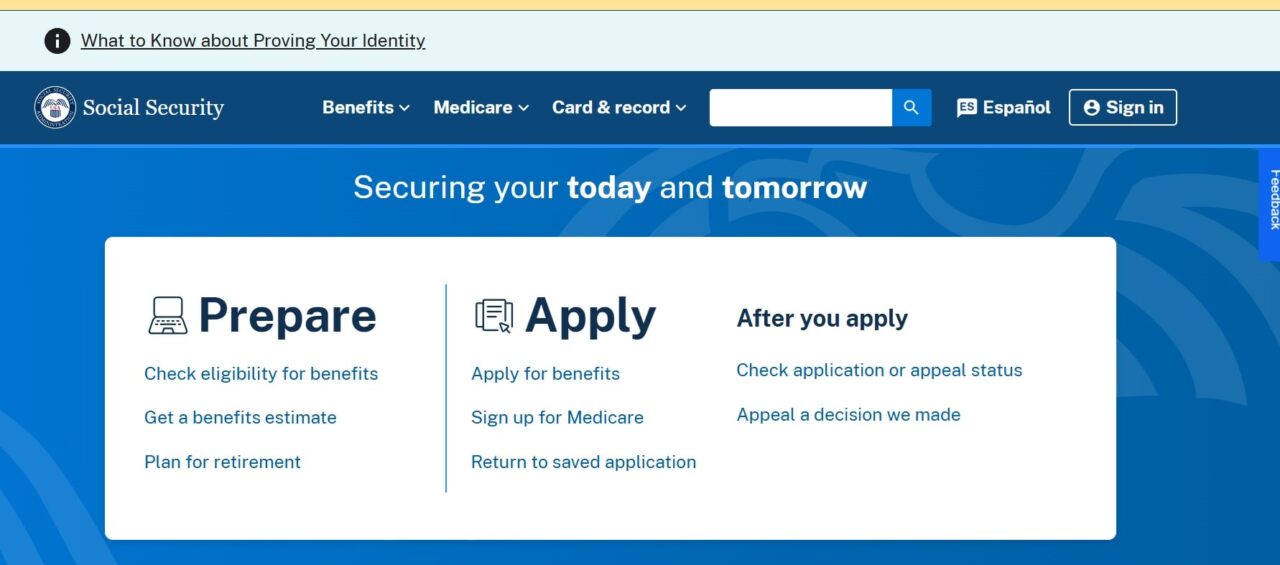

Sign up for Direct Deposit: Compared to checks, payments are safer and quicker.

Make an account with Social Security: Update personal information, view benefit details, and monitor payments here: Make an Account on official website.

Be wary of fraud: SSA will never ask for personal information over the phone or by email.

Early-month budget: You will receive two instalments in May and August and make sure to budget for the expenses of the next month.