Income Tax Return (ITR) Filing 2025: It is very important to file income tax returns for all the Indian citizens who earn income. File to e -return, we are not only our legal responsibility but also our moral responsibility because the revenue of the country increases and the country develops through income tax returns. This return filing provides complete information about your income sources to the government but also gives transparency related to income tax. Along with this, income tax payers also get financial and legal benefits due to income tax return filing.

Filing income tax returns is very important for all income tax payers as this process also provides various facilities to the Income Tax payers and also provides various benefits on filing income tax returns on time. It is very important to file income tax returns for all those countrymen who are salaried, employees or businessmen, which not only helps taxpayers in getting the benefit of financial facilities and government schemes, but also provide help in various types of investment schemes and details of various types of investment schemes and liabilities. In today’s article, we will discuss how ITR filing is necessary and what its major methods are.

Why is ITR filing necessary

The government receives revenue by doing ITR filing on time, as well as by filing ITR, it is ensured that you are paying your tax correctly. By doing ITR filing on time, the Income Tax Department pays the additional amount of your tax liability as refund. At the same time, ITR filing is considered as a valid proof of income and such people are provided with the benefit of government facilities in future without any other facilities. Income taxpayers who file ITR are given priority in other places like Visa application, loan approval, credit card application.

At the same time, such income taxpayers who pay income tax on time are also provided help by the Income Tax Department during the business deficit and adequate time to adjust the income of the next year.

E Pay Tax Service 2025 – Know about CBDT New Payment Method!

Tax Benefits for Senior Citizens 2025: Check Eligibility Criteria

Time limit and last date details for income taxpayers who file tax

Taxpayers who file non -audit tax

The last date for paying income tax for all such tax payers which does not require audit has been fixed on 31 July 2025. In such a situation, it is mandatory to file tax returns before 31 July 2025. However, the last date for paying tax with delay has been fixed at 31 October 2025.

Who are non -audit tax payers

Non -audit taxpayer are mainly people who do not need to conduct income audit. This category usually includes the following people.

- People who work under a company institution or government department and get a salary every month.

- Income tax payers who have retired and are receiving pension.

- Traders whose turnover is less than the prescribed limit.

- Such freelancers or professionals who are earning very low income which is less than the income tax limit.

- Such women, housewives or students who are earning less income than the taxable limit and do not give any talk to pay tax.

Taxpayers for whom Audit filing is necessary

The last date for filing tax returns for audit taxpayer has been fixed on 31 October 2025. It is mandatory to file your tax after preparing an audit report to such taxpayers. These taxpayers have to pay tax by filling the form under the Income Tax Act 44AB.

Who are taxpayers paying tax by filing an audit?

- The following people are included in this category, such big traders or industrialists whose turnover is more than one crore.

- Such professional doctors and lawyers whose annual income is more than 50 lakhs.

- Individuals who had been taken advantage of 44 Ed and later recorded loss or income details.

- Such tax filers or companies that fall under the legal structure and it is mandatory to audit them.

ITR filing for those receiving refunds

Tax payer whose income is not taxable but has to cut TDS due to investment or other reasons, he can file an ITR to get his refund. For example, there are many candidates whose monthly income is much less than the taxable income limit but due to various investment schemes, TDS is deducted and in such a situation, they have to file ITR to get refunds. For example, investors who have invested in fixed deposits or stock markets, whose total income is less than 2.5 lakhs, have to file an ITR to get this refund. The last date for filing ITR for all these has been fixed on 25 July 2025.

What can be the disadvantages of not filing ITR on time?

Tax payers for which audit is mandatory or audit is not mandatory or taxpayers who are mandatory to file tax to get refund, if they do not file tax at the scheduled time, then they can get the following types of damage to see the damage.

- 5000 punishment can be imposed on income above 5 lakhs.

- The same can also have to be paid for a penalty of ₹ 1000 on the same income less than 5 lakhs.

- Apart from this, one percent interest is also imposed on tax arrears.

- Also, taxpayers who did not fill ITR time are not given a chance to accommodate them in the following years during the deficit.

- Also, if a person cannot file a tax on time, then he has to wait to get the refund of returns.

- And government action is also taken against those who ignore this.

Tax Benefits for Solar Panels in India (2025): A Complete Guide for Homeowners

New Rules for Indian Workers in 2025: 4-Day Work Week & Major Salary Changes—Full Details Inside

How to do Income Tax Filing

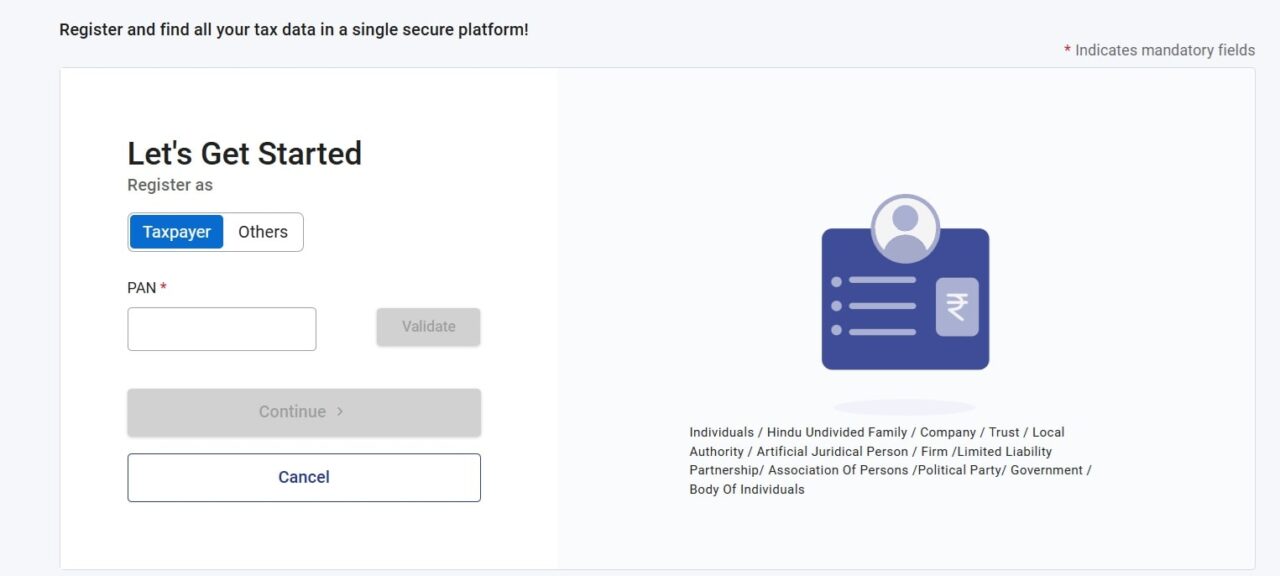

- To complete the process of income tax filing, all taxpayers have to go to the official portal at www.incometax.gov.in.

- The Login process will have to be completed, after completing the registration process.

- Then they have to choose the option for file income tax return.

- After selecting this option, filling the entire form and selecting the assessment year will have to be selected and

- Necessary details have to be filled carefully.

- After entering the details, the candidate will have to verify the return through Aadhaar OTP Net Banking EV and after filling the return, he will have to get the receipt and keep it safe with him.

Conclusion

Thus, such income taxpayers who are non -audit, audit or taxpayers who are required to file a return to get refunds can file their returns in time. Explain that the last date for filing returns for non -audit taxpayers is 31 July 2025. The last date for filing returns for taxpayers requiring the same audit has been fixed on 31 October 2025. The last date for filing returns for delay files has been fixed on 31 December 2025. Apart from this, such income tax payers who had made any mistake in filing the original returns can also file a revised return before 31 December 2025.

![Assam Circle Offers New Super Saving Plans- Family pack and Jeevan Sathi plan 2025 [Complete Guide] 5 Assam Circle New Super Saving Plans](https://sancharnet.in/wp-content/uploads/2025/02/Assam-Circle-New-Super-Saving-Plans-1024x576.jpg)

![Kerala Lottery Result Today Live 28 Feb 2025 : KARUNYA PLUS KN-563 Friday 3PM Draw 8 [LIVE] Kerala Lottery Result Today (28.02.2025) KARUNYA PLUS KN-563 Friday 3PM Draw](https://sancharnet.in/wp-content/uploads/2025/02/LIVE-Kerala-Lottery-Result-Today-28.02.2025-KARUNYA-PLUS-KN-563-Friday-3PM-Draw-1024x576.jpg)