GIS Payment Date May 2025: For Canadian seniors who rely on monthly government assistance, the Guaranteed Income Supplement (GIS) remains a vital source of financial relief in 2025. As inflation and living costs continue to climb, the GIS Payment Date May 2025 is highly anticipated by low-income seniors aged 65 and older.

This comprehensive guide covers everything you need to know about the GIS benefit—from confirmed payment dates and eligibility criteria to how to apply, monthly amounts, and common FAQs.

GIS Payment Date May 2025

The GIS payment for May 2025 is scheduled to be deposited on Monday, May 28, 2025. If you’re registered for direct deposit, the payment will reflect in your account on the same day. For those who receive mailed cheques, please allow additional days for delivery, especially if you reside in a remote area.

GIS Payment Schedule – Upcoming 2025 Dates

Knowing the GIS payment calendar helps seniors plan ahead and manage monthly expenses. below given are the scheduled payment dates for the year 2025:

| Month | GIS Payment Date |

| April 2025 | April 28, 2025 |

| May 2025 | May 28, 2025 |

| June 2025 | June 26, 2025 |

| July 2025 | July 29, 2025 |

| August 2025 | August 27, 2025 |

| September 2025 | September 25, 2025 |

$1700 CPP Payment for seniors in April 2025 – Check How to Claim?

New Social Security COLA payment 2025: Starting from 9th April, Check Who is eligible?

What is the Guaranteed Income Supplement (GIS)?

The Guaranteed Income Supplement (GIS) is a non-taxable monthly payment offered to low-income seniors who are already receiving Old Age Security (OAS). Introduced in 1967, GIS is designed to reduce poverty among elderly Canadians and ensure they can live with dignity.

Why GIS Matters in 2025?

- Helps seniors afford basic needs like food, housing, and medication.

- Offsets inflation and rising costs in Canada.

- Acts as a lifeline for those with little or no other income post-retirement.

GIS Eligibility Requirements

To get this GIS benefits in 2025, you must meet the following conditions:

- Be 65 years or older

- Be a Canadian resident

- Receive Old Age Security (OAS)

- Meet income threshold requirements

GIS Income Limits and Payment Amounts

Your benefit depends on your marital status and net income from the previous year. Here’s a breakdown of the maximum monthly payments and eligibility thresholds:

| Situation | Max Annual Income | Max GIS Payment (Monthly) |

| Single, Widowed, Divorced | Under $22,056 | $1,086.88 |

| Married (Spouse receives OAS) | Under $29,136 combined | $654.23 per person |

| Married (Spouse receives Allowance) | Under $40,800 combined | $654.23 per person |

| Married (Spouse not receiving OAS) | Under $52,848 combined | $1,086.88 |

Important: GIS is income-tested. Report all income sources, including CPP, RRSP withdrawals, investment income, and employment earnings.

How Your GIS Payment Is Calculated?

Your monthly GIS benefit is determined by:

- Your net income from the previous year (line 23600 on your tax return).

- Your marital status.

- Whether your spouse receives OAS, Allowance, or no benefits.

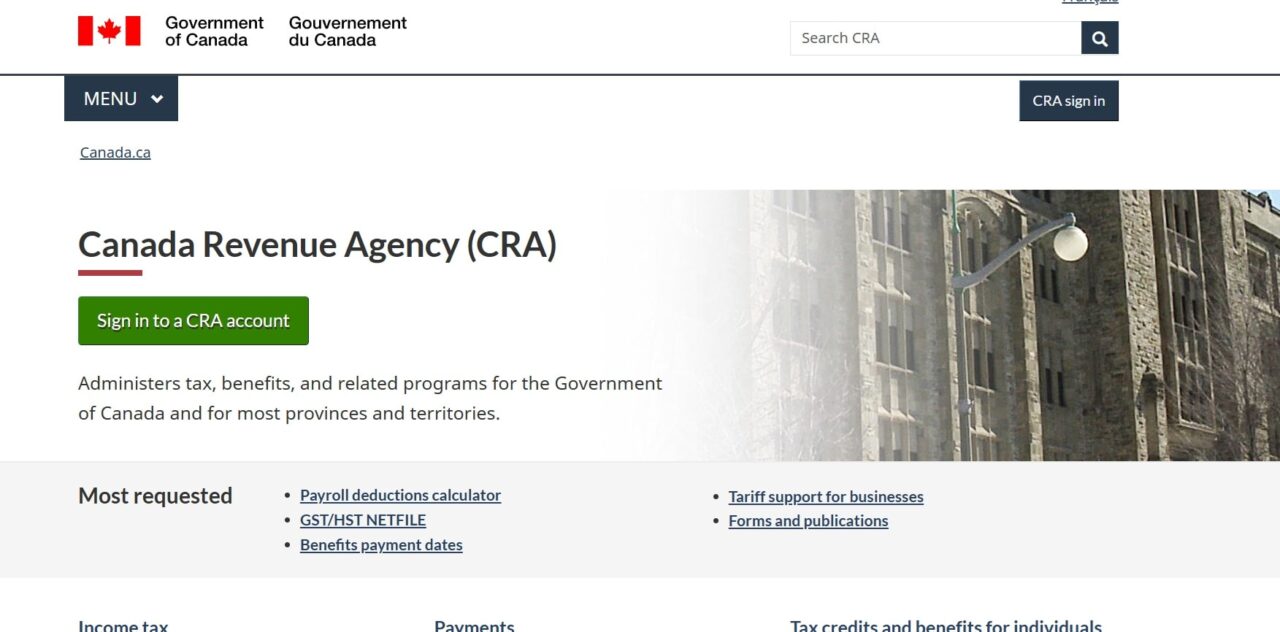

How to Apply for GIS in 2025?

If you’re not automatically enrolled when you start receiving OAS, you’ll need to apply for GIS. Here’s how:

Online Application

- Visit My Service Canada Account (MSCA).

- Fill out Form ISP-3025.

- Upload your ID, proof of income, and residency.

Paper Application (By Mail)

- Download and complete Form ISP-3025

- Attach required documents:

- Social Insurance Number (SIN)

- Bank details

- Proof of residency

- Mail to your nearest Service Canada processing office

Reminder: Your data is secure and handled under federal privacy protection laws.

Common GIS Application Mistakes to Avoid

- Missing the tax deadline (May 30, 2025) – This can delay or cancel your payments

- Failing to update marital or income status

- Incorrect income reporting – double-check all amounts

- Applying late – You may miss your payments (you can claim up to 11 months back)

Maximize Your GIS Benefits – Tips for Seniors

Here’s how to ensure you receive full and uninterrupted GIS payments:

- File taxes by May 30, 2025

- Sign up for direct deposit

- Promptly report life changes: marriage, divorce, moving, or loss of income

- Request income reassessment if your current year’s income dropped

- Apply early to receive retroactive benefits (up to 11 months)

Contact Details – Where to Get Help?

If you need help about your GIS application or payment:

- Service Canada: 1-800-277-9914

- Official GIS Page

- Visit a local Service Canada Centre

- My Service Canada Account for online services

Security Tip for Seniors

Always protect your personal information. Do not share your SIN, banking details, or My Service Canada credentials with anyone. Be cautious of emails or calls pretending to be from government agencies.

Singapore AP Cash Payout in 2025 – What are the accessible income criteria?

It’s Official: Cash App Settlement is Confirmed! Track Your $2,500 Payment

Conclusion :-

The GIS May 2025 payment is confirmed for May 28, and now is the best time to ensure your eligibility, update your personal information, and prepare for upcoming payments. As living costs continue to rise across Canada, this benefit plays a crucial role in enhancing the financial security of low-income seniors.

- File your taxes,

- Apply early if needed,

- Report any income or marital changes, and

- Stay informed with trusted sources like Canada.ca.

FAQs :- GIS Payment 2025

What is the GIS payment date for May 2025?

The payment will be deposited on Monday, May 28, 2025.

Who qualifies for GIS in 2025?

You must be :-

65+ years old

Reside in Canada

Receive OAS

Meet income limits

Can I apply for GIS online?

Yes. Use your My Service Canada Account to apply digitally.

What should i do if I miss the tax filing deadline?

Your GIS may be suspended or delayed until your taxes are filed.

My income dropped this year. Can I request a reassessment?

Absolutely. If your income recently declined (e.g., due to retirement or loss of a spouse), request an income reassessment with Service Canada.