E Pay Tax Service 2025: The Central Board of Direct Tax has recently released a new process for taxpayers. The convenience of taxpayers is being taken care of under this process. This new process of CBDT has been reduced to more simple and faster than before where taxpayers can now pay taxes directly without login using the new feature on the e-filing portal. Yes, this new process has been started under the Digital India campaign. Where various types of facilities are being provided to ordinary citizens through online medium so that taxis can be easier and accessible to pay taxes.

This new process launched by CBDT is being prevalent in the name of e -pay tax feature, which is allowing taxpayers to pay taxes through safe means. Under this payment process, the taxpayer is given complete exemption to make various payments like TDS and TCS by evaluating its own tax. Income tax payers are able to pay taxes easily without any technical difficulty or complex procedure using this new process.

Let us know what’s E Pay Tax Service 2025?

Let me tell you that this E Pay Tax process was quite complex earlier where the Income Tax payer had to login on the Income Tax Department website. At the same time, due to technical difficulties and complexity, it had to be registered again and again, in such a situation, the payment process was very difficult, but now only PAN number, mobile OTP without paying any people is being possible.

Canada Announces Potential $2600 Rent Relief Payment for Struggling Renters in 2025

E Pay Tax Service 2025 is an online facility of the Income Tax Department that helps taxpayers to pay taxes without any difficult procedure. Income tax payers are able to pay the following types of taxes under this E Pay Tax Service Process.

- Income tax payment

- TDS TCS Payment

- Self assessment tax

- Advance tax

- Other direct taxes

All these tax income tax payers are able to fill under various payment turns such as Net Banking Debit Card Credit Card UPI RTGS NEFT Bank Counter Check.

What is the benefit of this new feature launched by CBDT?

Due to this new feature launched by CBDT, the income tax payers have now got rid of the process of logging on the portal repeatedly. Now taxes are being easily paid without login on the portal. Rapid payment has become possible as soon as this new process is implemented, which is also saving the time of income tax payers.

Earlier, to pay taxes, the Income Tax payer had to enter various details on the portal and login in which many times the process was delayed due to technical error. But now all these problems have happened.

Under this process, the taxpayer can select the mode of payment as per his convenience and at the same time this process is available 24 hours and seven days, meaning these cars can be paid anytime as per their convenience.

CBDT’s objective to start E Pay Tax facility

The E Pay Tax facility has been started by CBDT to use the process of digitalization mainly so that taxpayers do not delay in paying taxes using the E -pay tax facility, but can easily pay this tax. Due to the E -Tax facility, the tax payment system is now becoming error -free, due to which many taxpayers who were hiccups to pay taxes or could not understand due to complexity, are now able to pay the textless text using this feature.

Along with this, due to the e -pay tax facility, now taxpayers are now getting permission to pay delayed tax which is completely transparent and it is also possible to track it. Because of this, taxpayers no longer need to login again and again, but such taxpayers who are not familiar with technology are now able to pay their tax only as soon as they are verified OTP.

Who can use E Pay Tax Service facility?

- Any individual taxpayer can use the e -pay tax facility.

- Under this facility, many business firms, companies can pay their tax.

- The same people or institutions who bite TDS or TCS can also pay tax using e -pay tax facility without login.

- Also, people who pay advance tax or self -assessment tax can also pay tax by evaluating self.

- Along with this, CA, tax consultants and representatives are also being used in which separate OTP is generated for each person.

How to use E Pay Tax features?

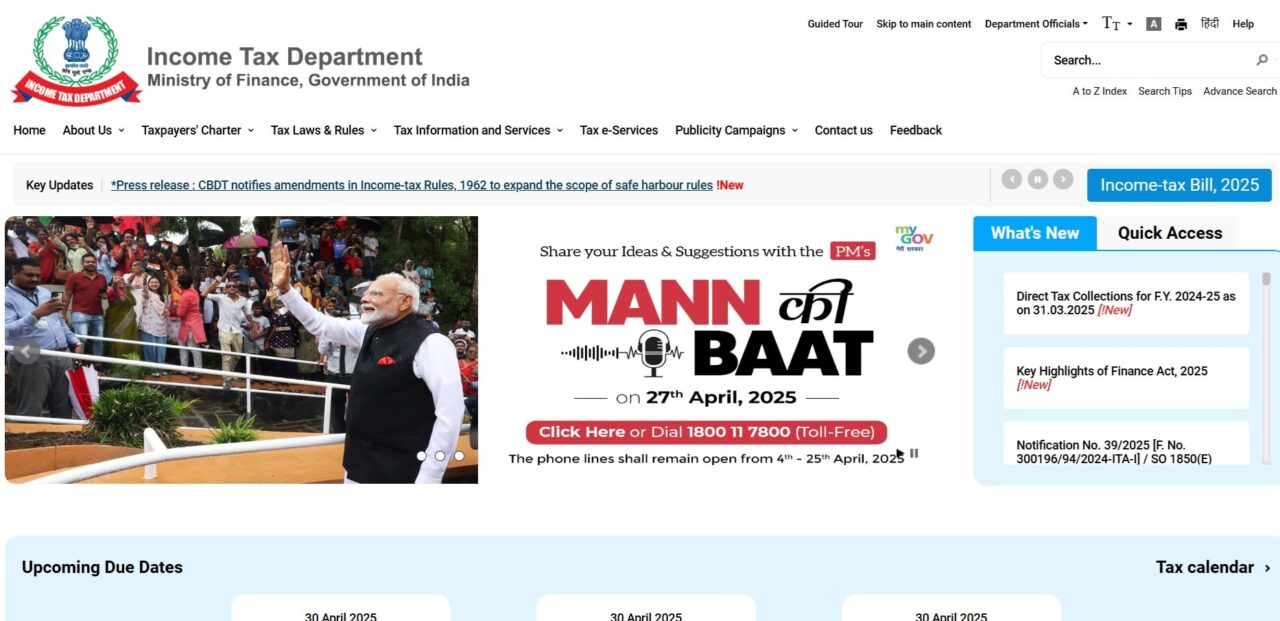

- To use the E Pay Tax Service 2025 feature, the taxpayer must first go to the E -filing website of the Income Tax Department.

- On the home page of this website, the taxpayer will have to click on the choice of the Quick Link.

- After clicking on this option, clicking on the Kardatako e -pay tax option will have to enter your PAN number or tan number and enter the mobile number.

- OTP comes on the candidate’s mobile as soon as the mobile number is recorded, the candidate has to verify this OTP.

- The challan is generated as soon as the OTP is verified.

- After the challan is generated, the candidate has to select the payment mode.

- After you select your payment gateway, you have to complete the payment.

- As soon as the payment is completed, the tax process ends and the receipt is given.

- The candidate has to download this receipt and save it near him.

Mobile Recharge Plan Increase in 2025 – Know about your mobile plan!

$750 OAS Payment for Seniors In May 2025: Eligibility, Dates & Facts

Conclusion

Thus all those taxpayers who want to pay their taxes but do not want to s in the mess of the login process can pay tax using pay tax facility without login.