$7,437 Child Benefit Per Child in Canada: Up to $7,437 Per Child — Who Qualifies and How to Apply

Families across Canada continue to feel the pinch of rising expenses, especially when it comes to raising children.

That’s where the Canada Child Benefit (CCB) steps in — a tax-free monthly payment provided by the Canada Revenue Agency (CRA) to help parents cover the costs of raising children under 18. For this year, beneficial families may receive up to $7,437 child benefit payment.

What is the Canada Child Benefit (CCB)?

The $7,437 Child Benefit is a financial support program from the Government of Canada, designed to help low- and middle-income families manage child-rearing costs. Payments are made monthly and vary depending on several factors, including:

- Your family’s annual net income

- The number of children in your care

- The age of each child

- Whether your child qualifies for the Disability Tax Credit (DTC)

- The benefit is non-taxable and is typically deposited around the 20th of each month.

$1400 Recovery Rebate Credit 2025 – Know Eligibility & Deadline to fille Return is 15th April,

Singapore $3267 Workfare Income Supplement April 2025: Are you Eligible?

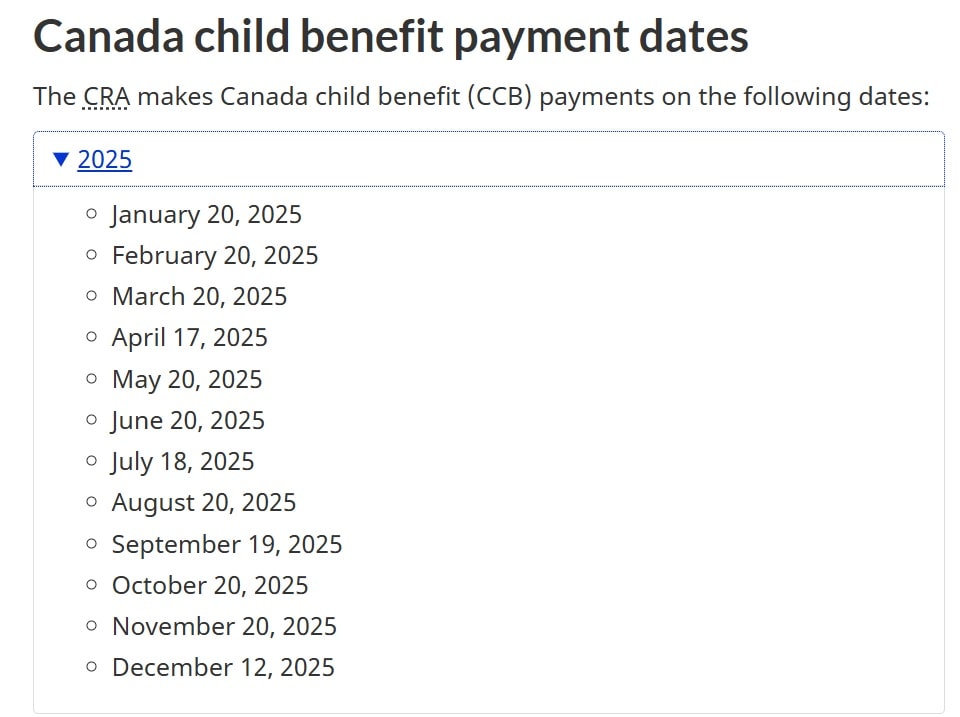

CCB April 2025 Payment Date

Since April 20, 2025, falls on a weekend and April 18 is a public holiday (Good Friday), families will receive their CCB payments early on April 17, 2025.

CCB 2025 Payment Schedule

How Much Can You Get in 2025?

The maximum annual CCB amounts have increased due to inflation:

- Children under 6 years old: Up to $7,437 annually

- Children aged 6–17: Up to $6,275

- However, in July 2024, payments were adjusted to:

- $7,787 for children under 6

- $6,570 for children aged 6 to 17

- A smaller increase of 2.7% is expected in July 2025, bringing the maximum benefit for children under 6 to approximately $7,997.

Who Is Eligible for the Canada Child Benefit in 2025?

To receive CCB payments, you must:

- Be a resident of Canada

- Live with and be the primary caregiver of a child under 18

- Be responsible for the child’s daily care and upbringing

- Have filed your taxes for the previous year (both parents or caregivers must file, even with no income).

How to Apply for the CCB?

To apply for the Canada Child Benefit:

- Visit the official CRA website at canada.ca.

- Select “Apply for Child Benefits”

- Provide personal details, including:

- Your and your child’s Social Insurance Numbers (SINs)

- A birth certificate or adoption papers

- Your household income and tax details

- You can apply online through your CRA account or by mail.

How Is Your CCB Calculated?

- Your annual benefit amount is based on your Adjusted Family Net Income (AFNI) from the previous tax year, and includes:

- The number of children in your care

- Their ages

- Eligibility for any disability credits

- The CRA reassesses and adjusts payments each July, based on the prior year’s tax return. You’ll receive a notice detailing your new payment amount.

Don’t Ignore This! New Rule Could Block Your Social Security Benefits

£187.45 UK Disability Benefits Rising in April 2025: Are You Eligible?

Why the CCB Matters?

The Canada Child Benefit helps families afford essential needs — from daycare and school supplies to food, clothing, and more. Many households rely on this financial support to stay afloat during tough economic times. With yearly inflation adjustments, the CCB continues to be a vital lifeline for Canadian families raising children.

Mostly Asked Question’s :-

What is the $7,437 Canada Child Benefit for 2025?

It is a tax-free monthly payment issued by the Canada Revenue Agency (CRA) to support parents and guardians with the cost of raising children.

When This amount is going to be released by the CRA?

Since April 20, 2025, falls on a weekend and April 18 is a public holiday (Good Friday), families will receive their CCB payments early on April 17, 2025.

Do I need to apply every year?

No, once you’re approved, you do not need to reapply every year. However, you and your spouse/partner must file your income tax returns each year, even if you earned no income, to continue receiving payments.

Is This CCB considered taxable income?

No, the Canada Child Benefit is completely tax-free.

Will my payment amount change during the year?

The CRA recalculates payments annually in July, based on your previous year’s income. However, your payment amount may change mid-year if :-

Your marital status changes

Your custody arrangements change

Your family income changes significantly