$2200 Monthly Social Security Direct Deposit in May 2025: The Social Security Administration (SSA) administers various programs, including Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), to support eligible individuals. While some beneficiaries may receive monthly payments close to $2,200, it’s essential to understand that this amount is not a standardized payment for all recipients.

For millions of Americans, Social Security benefits represent a crucial financial lifeline during retirement years. With many retirees receiving approximately $2,200 monthly through direct deposit, understanding how this system works can help ensure financial stability and peace of mind. This comprehensive guide explores everything you need to know about receiving your Social Security benefits through direct deposit, addressing common questions and providing practical solutions to potential challenges.

$2200 Monthly Social Security Direct Deposit in May 2025 Key Points

- No Universal $2,200 Payment: The SSA has not announced a universal $2,200 monthly payment for all beneficiaries in 2025.

- Benefit Amounts Vary: Monthly benefits depend on factors such as earnings history, age at retirement, and the specific program under which one qualifies.

- Cost-of-Living Adjustments (COLA): In 2025, a COLA of 2.5% has been applied, increasing average benefits but not uniformly to $2,200 for all recipients.

Eligibility Criteria for Social Security Benefits

To qualify for Social Security benefits, applicants must meet specific criteria:

General Requirements:

- Age: Typically, individuals aged 65 or older, or those with qualifying disabilities.

- Income: Limited income as defined by SSA guidelines.

- Resources: Assets below specified thresholds ($2,000 for individuals, $3,000 for couples).

- Citizenship: Must be a U.S. citizen or meet certain immigration status requirements.

Program-Specific Requirements:

- SSDI: Requires a certain number of work credits and a qualifying disability.

- SSI: Intended for people with low incomes and assets, irrespective of their employment history.

$1700 CPP Payment for seniors in April 2025 – Check How to Claim?

New Social Security COLA payment 2025: Starting from 9th April, Check Who is eligible?

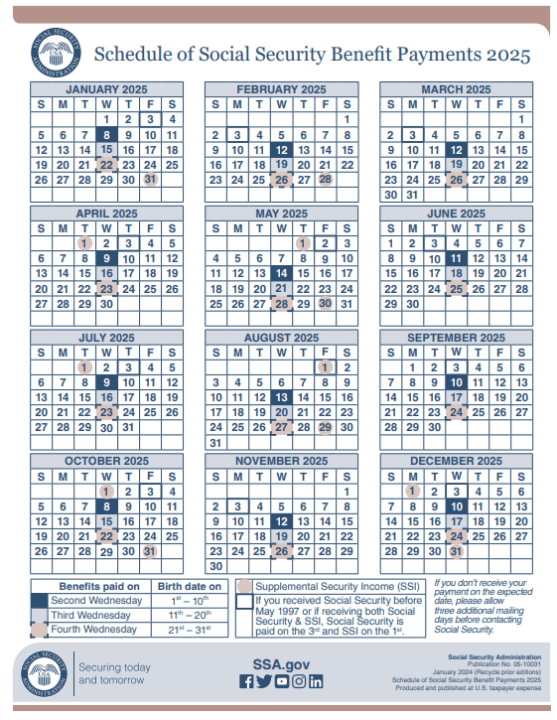

Direct Deposit Payment Schedule for $2,200 Benefits

The Social Security Administration (SSA) distributes payments according to a predictable monthly schedule based on your birth date:

- If you were born on the 1st through 10th: Payments arrive on the second Wednesday

- If you were born on the 11th through 20th: Payments arrive on the third Wednesday

- If you were born on the 21st through 31st: Payments arrive on the fourth Wednesday

For those who started receiving benefits before May 1997 or who receive both Social Security and SSI benefits, payments typically arrive on the 3rd of each month.

Understanding this payment schedule helps recipients plan their monthly finances with greater precision. For those receiving approximately $2,200 monthly, knowing exactly when these funds will become available allows for better coordination with bill payment dates and other financial obligations.

Is There a $2,200 Flat Payment for All in 2025?

No. The SSA has not issued any official statement regarding a universal $2,200 monthly payment. Benefit amounts are individualized based on various factors.

Will Everyone Receive a $2,200 Payment Due to COLA?

Not necessarily. While the 2.5% COLA increases benefits, the final amount varies per individual. Some may see their benefits approach $2,200, but it’s not a guaranteed amount for all.

How to Apply for Social Security Benefits

Steps to Apply:

- Visit the SSA Website: www.ssa.gov

- Fill out the application by entering the required financial and personal data.

- Submit Required Documents: This may include identification, proof of income, and medical records.

- Await Confirmation: The SSA will review your application and notify you of the decision.

Singapore AP Cash Payout in 2025 – What are the accessible income criteria?

It’s Official: Cash App Settlement is Confirmed! Track Your $2,500 Payment

Conclusion

While discussions about a universal $2,200 monthly Social Security payment have circulated, it’s crucial to rely on official information from the SSA. Benefit amounts are individualized, and while some may receive payments near this figure, it’s not a standard amount for all. For accurate and personalized information, always consult the SSA directly or visit their official website.

For the millions of Americans receiving approximately $2,200 monthly through Social Security direct deposit, understanding the system’s nuances helps ensure financial stability and peace of mind. By familiarizing yourself with payment schedules, enrollment procedures, troubleshooting techniques, and recent system enhancements, you can maximize the value and reliability of this essential benefit.

Direct deposit represents the safest, most convenient method for receiving your hard-earned Social Security benefits. Whether you’re already receiving benefits or planning for future retirement, the security and reliability of electronic payments provide a solid foundation for managing your monthly income of around $2,200.

By staying informed about your benefits and maintaining accurate banking information, you can ensure uninterrupted access to this crucial financial resource throughout your retirement years.

FAQs About $2200 Monthly Social Security Direct Deposit in May 2025

Can I receive both SSDI and SSI benefits?

Yes, provided that you fulfill the requirements for both programs. Concurrent benefits is the term used for this.

How is my benefit amount calculated?

Your earnings history, retirement age, and the particular program you are eligible for all influence how much you receive in benefits.

Are Social Security benefits taxable?

Depending on your overall income, yes. Federal income taxes may need to be paid by certain recipients of Social Security benefits.

How can I check my benefit status?

You can create a “my Social Security” account on www.ssa.gov to view your benefit information.