PAN-Aadhaar Linking Deadline 2025: As part of the government’s mission to strengthen financial transparency and reduce tax-related fraud, linking your PAN (Permanent Account Number) with Aadhaar has been made mandatory. With the final deadline set for June 30, 2025, it is crucial for all eligible individuals to complete this process to avoid severe financial and legal consequences.

In this guide, you’ll find everything you need to know about PAN-Aadhaar Linking Deadline 2025 — including why it’s essential, how to do it, who is exempt, and what happens if you miss the deadline.

Why PAN-Aadhaar Linking Is Mandatory?

The Indian government has introduced the PAN-Aadhaar Linking 2025 mandate under the Income Tax Act to improve accuracy in financial records and curb tax evasion. By linking both documents, the government can ensure:

- Elimination of duplicate or fraudulent PANs.

- Better tracking of financial transactions.

- Efficient processing of tax returns and government subsidies.

- Simplified KYC procedures for banks and financial institutions.

Failing to link PAN and Aadhaar may render your PAN inoperative, affecting everything from tax filings to investment-related activities.

$2450 Cash Boost for Working Men in New CPP Overhaul?

Singapore $3267 WIS Payment 2025: Eligibility, Monthly Dates & Full Guide

PAN-Aadhaar Linking Deadline 2025 : June 30, 2025

If you haven’t linked your PAN with Aadhaar yet, June 30, 2025 is your final chance to do so without penalties. Here’s what happens if you miss the PAN-Aadhaar Linking Deadline :-

| Activity | Impact After Deadline |

|---|---|

| PAN Status | Becomes inoperative |

| ITR Filing | Not allowed with inactive PAN |

| Bank Transactions | Blocked |

| Mutual Fund Investments | Suspended |

| Stock Market Access | Frozen |

| Government Subsidies | Delayed or withheld |

| KYC Compliance | Rejected |

After the deadline, reactivating your PAN will require a ₹1,000 penalty and may take up to 30 days for processing.

Who Needs to Link PAN and Aadhaar?

Most Indian citizens must link their PAN with Aadhaar. However, certain groups are exempt, including:

- Non-Resident Indians (NRIs)

- Residents of Assam, Meghalaya, and Jammu & Kashmir

- Senior citizens aged 80 years or older

- Foreign nationals residing in India

If you fall under one of these categories, linking PAN and Aadhaar is not mandatory.

How to Link PAN with Aadhaar: 2 Simple Methods

You can complete the linking process in just a few minutes using either of the following methods:

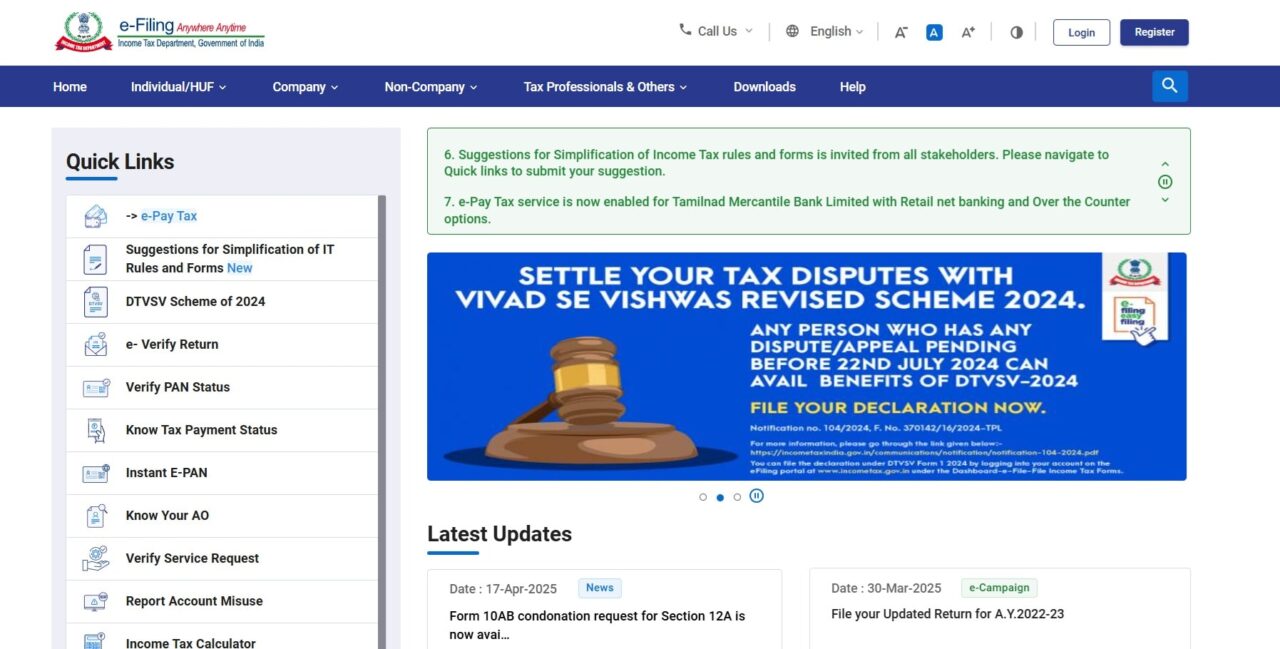

Method 1: Online via Income Tax e-Filing Portal

- Visit the official website: www.incometax.gov.in.

- Click on “PAN-Aadhaar Linking 2025 ” under the Links section.

- Enter your PAN number and Aadhaar number.

- Provide your name as per Aadhaar.

- Tick the declaration checkbox and click “Link Aadhaar”.

- Enter the OTP sent to your registered mobile number.

- Submit and wait for confirmation.

Method 2: Through SMS

You can also do PAN-Aadhaar Linking by sending an SMS:

- Open your phone’s messaging app

- Type:

UIDPAN <12-digit Aadhaar> <10-digit PAN> - Send to 567678 or 56161

You’ll receive a confirmation message once your PAN and Aadhaar are successfully linked. If you’re unsure whether your PAN is already linked to Aadhaar, follow these steps:

- Visit: www.incometax.gov.in

- Click on “Link Aadhaar Status”

- Enter your PAN and Aadhaar numbers

- The status get displayed on the screen

If your PAN is not linked, you should act immediately to avoid penalties.

Penalty for Missing the PAN-Aadhaar Linking Deadline

Failing to complete the linking process before June 30, 2025, will lead to the following consequences:

- ₹1,000 late fee for reactivation

- PAN becomes inoperative, making it unusable for any financial or legal purpose

- Delay of up to 30 days in reactivating your PAN

- Income Tax Returns filed with an inactive PAN will be deemed invalid

| Scenario | Outcome |

|---|---|

| PAN not linked by deadline | PAN becomes inoperative |

| ITR filed with inoperative PAN | ITR is rejected |

| Financial transactions with inactive PAN | Denied or blocked |

| No reactivation request filed | May attract legal issues |

What Happens If Your PAN Becomes Inoperative?

An inoperative PAN card can significantly impact your financial freedom. Here are some of the disruptions you might face:

- Inability to file or verify income tax returns.

- Blocking of bank transactions above ₹50,000.

- Suspension of mutual fund SIPs and redemptions.

- Freezing of stock market portfolios.

- Delays in insurance payouts due to failed KYC.

- Withholding of government subsidies and pensions.

- Ineligibility for loans, credit cards, and new bank accounts.

Final Tips to Stay Compliant

- Verify your PAN-Aadhaar status today via the official income tax portal

- Avoid last-minute delays due to server overload or mobile OTP issues

- Ensure your mobile number is updated and active to receive verification codes

- If you’re facing issues online, use the SMS method as an alternative

$697 Direct Deposit Checks 2025: Check Payment Details, Eligibility & Application Process

SBI PO Mains Admit Card 2025 Released – Exam date: 05th may, Download Now at sbi.co.in

Don’t Miss the Deadline – Link Your PAN and Aadhaar Today

The PAN-Aadhaar linking process is quick and straightforward, but the consequences of missing the PAN-Aadhaar Linking deadline can be long-lasting. Whether you’re a salaried employee, business owner, or investor, having an active PAN is essential for smooth financial transactions, tax compliance, and access to government schemes. Take 5 minutes now to complete the process and avoid unnecessary stress later.

Disclaimer: This article is intended for informational purposes only. For the latest updates and official instructions, please visit the Income Tax Department website.

PAN-Aadhaar Linking: Frequently Asked Questions (FAQ’s)

Q1. Can I still link PAN and Aadhaar after June 30, 2025?

Yes, but you must pay a penalty of ₹1,000 and wait for your PAN to be reactivated.

Q2. Can I file ITR if my PAN is inactive?

No. An inoperative PAN renders your ITR invalid, which may lead to penalties or rejections.

Q3. Will I get reminders about the linking deadline?

Usually, the Income Tax Department sends reminder alerts via SMS and email before the deadline.

Q4. Can PAN and Aadhaar be unlinked once connected?

No. Once linked, the PAN-Aadhaar association is permanent.