Next Tax Refund Date In 2025: American Citizens are waiting for their next tax refund. Are you worried for checking the status? If you are constantly checking, then that will only not add anything rather it will make you worried. It is natural for tax payers to keep track of their tax return, but doing it unknowingly could not help you. One of the best resources is the IRS’s “Where’s My Next Tax Refund?” page and here you can monitor your refund status using basic details from your tax return. If you have filed via online or electronically, then it will fetch your early refund. You can typically expect your refund to arrive sooner than if you have submitted via offline.

By the end of the previous month, the authority has done the processing of over 78 million tax returns and has issued more than 55 million refunds. If you are one of the many Americans who have filed their tax return but haven’t received the Tax Refund yet then you might be curious about where it is. The IRS provides a straightforward tool that allows you to check the Next Tax Refund status of your refund and any funds owed to you.

Next Tax Refund Date In 2025

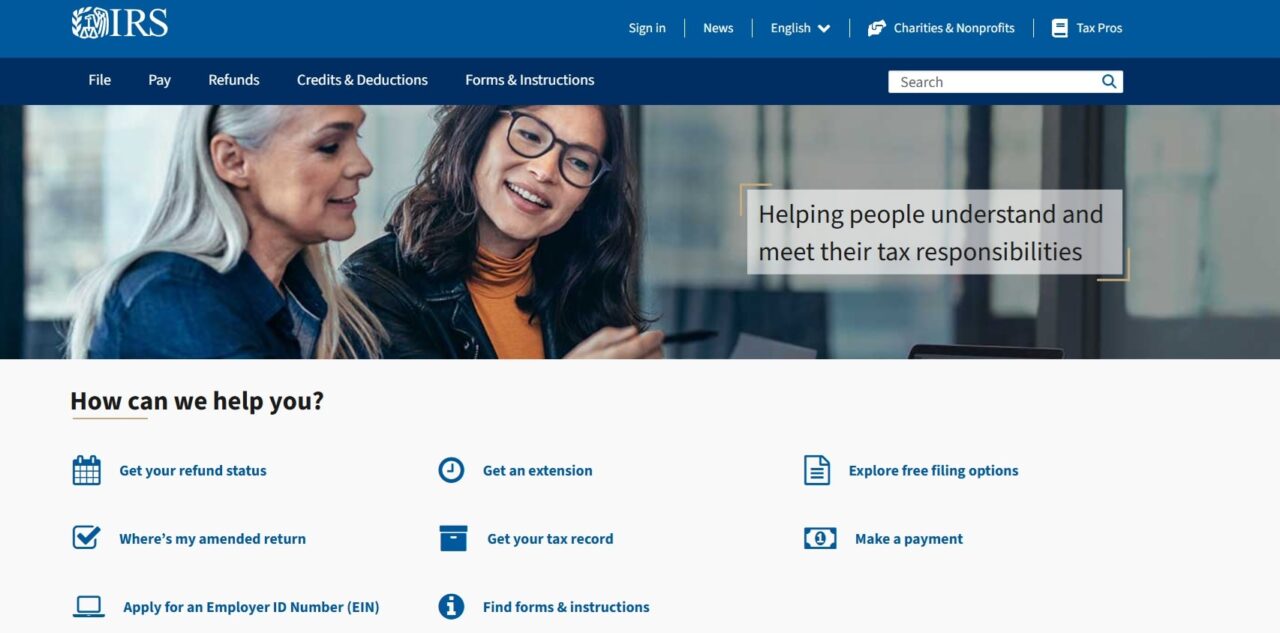

To know about your 2025 tax refund, you have to use a coolest tool which is known as “Where’s My Refund?’. This tool is made by the IRS. This tool provides updates on your Tax Refund status and can warn you if there are any problems with your return including potential rejections due to mistakes. The information is refreshed daily during the night. To avoid rejection you have to provide the correct information before at the time of filing the return.

$890 Centrelink Bonus Payment April 2025: Check New Update & Payment Date

$250 One-Time Payment for Singapore Civil Servants: Check Payment Dates, Eligibility and All Details

How can someone track or check the Tax Refund status?

The eligible tax payers have to check all the requirement clauses before accessing the tracker.

- To use the tracker, the tax filer has to enter their Social Security number or Individual Taxpayer Identification Number, their filing status like whether he/she is a single filer or a married couple or a head of the household and the refund amount in whole dollars.

- The tax filers can check the status of their tax return after the acceptance done by IRS and this process usually happens within 24 hours of e-filing.

- At first go to the tracker section on the IRS website and select the Check your refund button.

- This will take you to the Refund Status page.

- On this page, you can input your information and then can click Submit.

- You will then be able to view your refund status.

- Always have patience because remember that it may take up to three weeks for your refund to be processed and delivered after acceptance.

- If you have done it electronically through tax software, the provider will typically send you an email confirmation when the IRS or your state tax department accepts your return.

- You can also log into the software and can check the acceptance status and find out your expected refund amount.

- Normally e-filed returns are accepted by the IRS within 24 to 48 hours.

- At the mean time offline applications can take about four weeks.

Different meanings of Status

You can see your current status on the tracker from its different status. It will show you the reality that whether it’s being accepted or approved for a refund or if the refund has been sent to your bank account.

- If you will see that ‘Received’ is written then it means the IRS has your tax return and is in the process of handling it.

- Then you will see another option that is “Approved” this means that the IRS has completed processing your return and verified the refund amount, in the case of eligible tax filer.

- If you will see the status “Sent” is written there then it means your tax refund is being delivered to your bank through direct deposit or as a paper check mailed to your address.

Social Security Payments Schedule for April 2025: What to Expect on April 9 & Who Qualifies?

$697 Direct Deposit Checks 2025: Check Payment Details, Eligibility & Application Process

If there is any delay, then what to do?

There are several reasons you will know later for your delay in getting the refund.

- One of the common issues is filing the tax return with errors.

- The tax filers might have possessed an incorrect SSN or might have given their bank or address details incorrect.

- One of the reasons might be that it may need further review or if your return is incomplete.

- If the applicants claimed the earned income tax credit or the additional child tax credit then the IRS is not allowed to issue your refund until mid-February.

- It has been noticed that those who have filed early with accurate returns and opted for direct deposit should have received their refunds around March 3.

- If you are still waiting for your refund then wait for at least three weeks or six weeks after mailing your filed return.

- If there is no update regarding you returns on the page of “Where’s My Refund?” tracker or your IRS online account then kindly contact the IRS for assistance.

You can also monitor your refund status on your smart phone by downloading the IRS2go mobile app or by calling the IRS’s automated refund hotline at 800-829-1954.

Usually Asked Doubts :-

What’s the full name of IRS?

Internal Revenue Service.

When is e-filed return accepted?

Normally e-filed returns are accepted by the IRS within 24 to 48 hours.

What is the official webpage to check the payment status?

irs.gov.