$2831 Social Security Benefit 2025 at Age 62: Are you wondering whether the $2,831 Social Security benefit for 62-year-olds is real or just another internet hoax? You’re not alone. With so many viral claims and clickbait headlines floating around, it’s easy to get confused. The truth is—the $2,831 monthly Social Security benefit is real, but it’s not available to everyone. Only a specific group of high earners qualifies for this maximum early retirement payout.

In this guide, we’ll break down who’s eligible for this $2831 Social Security Benefit, how Social Security calculates payments, and how you can plan your retirement more effectively.

Is $2831 Social Security Benefit Real?

Yes, the $2831 Social Security Benefit at age 62 in 2025 is real. However, it applies only to individuals who meet very specific financial and work history criteria.

According to the Social Security Administration (SSA), the average monthly benefit for someone claiming retirement at 62 is around $1,298—less than half of the maximum. So while $2831 Social Security Benefit is possible, it’s far from typical.

$700 Health Bonus for Singapore Seniors in 2025: What’s Next in Healthcare Support?

Centrelink Australia Old Age Pension May 2025 Update: Critical Deadlines You Must Know & All Details

Eligibility Criteria for the $2831 Social Security Benefit

To receive the maximum benefit at age 62, you must meet all the following requirements:

- Worked for at least 35 years.

- Earned the maximum taxable income every year during that time.

- Paid into Social Security consistently with no major employment gaps.

- Claimed benefits when you are 62 years old, which is the earliest possible age.

What is Maximum Taxable Income?

Every year, the Social Security Administration sets a cap on taxable income for Social Security. In 2025, that cap is $168,600. Any income earned above this limit isn’t taxed for Social Security and doesn’t increase your benefits.

So to qualify for the maximum $2831 Social Security Benefit, you must have earned at least this amount annually for 35 years—something usually achievable only by high-income professionals like doctors, executives, and senior engineers.

How Social Security Benefits Are Calculated?

Understanding the formula behind your $2831 Social Security Benefit is key to planning. The SSA uses two main calculations:

- Average Indexed Monthly Earnings (AIME):

- Based on your highest 35 years of earnings, adjusted for wage inflation.

- Primary Insurance Amount (PIA):

- This is your full benefit if you retire at your Full Retirement Age (FRA), which is 67 for most people today.

- If you claim at 62, your benefit is permanently reduced—up to 30% less than what you’d get at FRA. That’s why someone with a PIA of $4,044 at 67 would receive $2,831 at 62.

Real-Life Example

- Imagine someone earned the maximum taxable income ($168,600 or more) every year for 35 years. Their PIA at full retirement age might be $4,044/month in 2025. If they claim benefits early at age 62, they’ll get about $2,831/month—the maximum for early retirees.

For most people, though, inconsistent income, gaps in employment, or lower wages will result in significantly smaller payouts.

Should You Take Social Security at Age 62?

Claiming $2831 Social Security Benefit early has both advantages and drawbacks.

- Pros:

- Immediate income: Helps if you retire early or face unexpected expenses.

- Health issues: Makes sense if you have a shorter life expectancy.

- Flexibility: Offers financial breathing room for part-time work or lifestyle changes.

- Cons:

- Permanent reduction: Up to 30% less than your full benefit.

- Longevity risk: You may outlive your retirement savings.

- Lower survivor benefits: Affects what your spouse may receive.

If you can afford to wait until 67 or even 70, your monthly benefit increases substantially—up to 8% more per year past FRA.

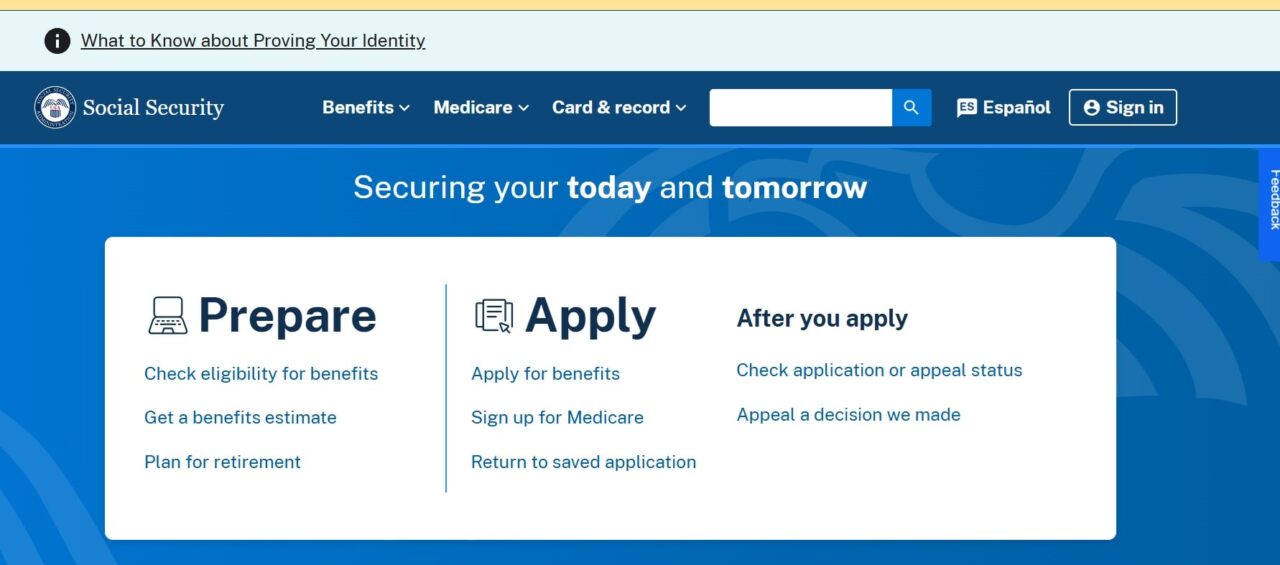

How to Check Your Social Security Eligibility?

Want to know how much you’re eligible to receive? Here’s what you should do:

- Create a My Social Security Account: Visit ssa.gov/myaccount.

- Review Your Earnings Record: Ensure there are no gaps or errors.

- Use the Retirement Estimator Tool: Compare expected benefits at 62, 67, and 70.

- Speak With a Financial Advisor: Personalized advice can help maximize your income.

Factors That Influence Your Monthly Benefit

Your retirement $2831 Social Security Benefit is determined by more than just income. Here are additional factors that impact your payment:

- Work History: Less than 35 years? The SSA will average in $0 for the missing years, reducing your benefit.

- Spousal Benefits: Spouses may qualify for up to 50% of your benefit or survivor benefits.

- Continuing to Work: If you claim before FRA and earn over $22,320 in 2025, your benefit may be reduced.

- COLA Increases: Social Security includes annual Cost of Living Adjustments to keep up with inflation.

How to Maximize Your Social Security Benefits?

If you want to get the most out of your Social Security payments, consider the following strategies:

- If you are late in till your full retirement age or later if possible.

- Earn more income, especially in the later years of your career.

- Work at least 35 years to avoid $0s pulling down your AIME.

- Coordinate benefits with your spouse for maximum household income.

- Avoid early filing during high-income years to prevent reductions.

CRA Rebate Missed In May 2025? Find Out Why? Check What to Do

Canada $628 Grocery Rebate For May 2025 -Eligibility Criteria And Payment Dates!

Final Thoughts

While the $2,831 Social Security benefit at age 62 is certainly real, it’s not common. Most Americans won’t qualify for this maximum payment, but that doesn’t mean you can’t plan for a comfortable retirement. By understanding how the system works, reviewing your earnings, and using available tools, you can make smarter decisions for your financial future.

FAQs: $2,831 Social Security at Age 62

Can I really get $2,831/month at age 62?

Yes, but only if you meet strict requirements: 35 years of top-tier earnings and no employment gaps.

What is the average benefit at age 62?

Roughly $1,298/month in 2025, according to SSA statistics.

Is it better to wait until 67 or 70?

Yes, in most cases. Waiting increases your monthly payments significantly.

Can I still work while receiving benefits?

Yes, but if you’re under FRA and earn more than $22,320, some benefits may be temporarily withheld.

Where can I check my benefit estimate?

Visit ssa.gov/myaccount to use the Retirement Estimator tool.

![Assam Circle Offers New Super Saving Plans- Family pack and Jeevan Sathi plan 2025 [Complete Guide] 4 Assam Circle New Super Saving Plans](https://sancharnet.in/wp-content/uploads/2025/02/Assam-Circle-New-Super-Saving-Plans-1024x576.jpg)

![Kerala Lottery Result Today Live 28 Feb 2025 : KARUNYA PLUS KN-563 Friday 3PM Draw 7 [LIVE] Kerala Lottery Result Today (28.02.2025) KARUNYA PLUS KN-563 Friday 3PM Draw](https://sancharnet.in/wp-content/uploads/2025/02/LIVE-Kerala-Lottery-Result-Today-28.02.2025-KARUNYA-PLUS-KN-563-Friday-3PM-Draw-1024x576.jpg)